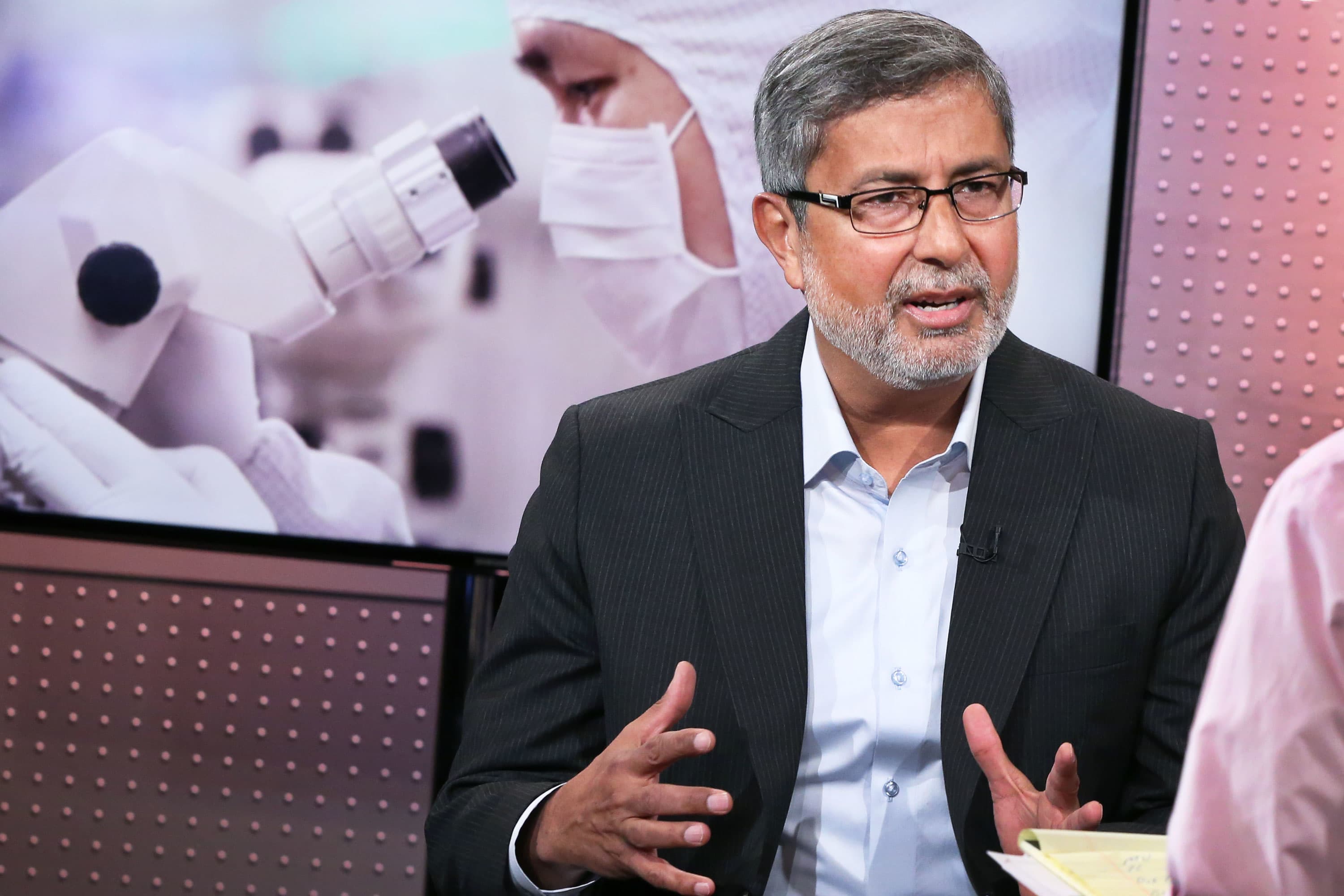

Micron CEO Sanjay Mehrotra Sees Growth in Automotive and 5G Semiconductors

[ad_1]

Micron Technology expects tremendous growth in semiconductors for 5G and electric vehicles as the global economy recovers from a pandemic, CEO Sanjay Melotra told CNBC on Thursday.

“Today’s market is more diverse than ever. It will be automobiles, electric vehicles and, in the future, wheel data centers that will require more memory and storage. Certainly smartphones, data centers, “games, industrial applications” all contribute to the growing need for chips, Mehrotra said of “TechCheck”. “We are seeing a healthier and stronger demand environment than ever before. “

Micron, which manufactures memory chips used in data storage, smartphones and a variety of other computing devices, reported higher than expected quarterly sales and profits on Wednesday. Its fourth quarter profit forecast also exceeded analysts’ expectations.

According to IBES data from Refinitiv, chipmakers are forecasting fourth-quarter revenue of $ 8.2 billion, plus or minus $ 200 million, with analysts forecasting an average of $ 7.87 billion.

According to Refinitiv, as Wall Street sought $ 7.24 billion, Micron’s third-quarter revenue was up 36% to $ 7.42 billion. Earnings per share, excluding items, was $ 1.88, higher than expected at $ 1.72.

The pandemic has resulted in “an acceleration of digital transformation” and a significant semiconductor shortage that will spill over into the global economy, Merotra said. For example, on Wednesday, Ford Motor Company announced a new round of production delays due to chip cracking.

However, rising prices due to supply pressure and the shift to remote working in the age of Covid have helped Micron.

Mehrotra anticipates further favorable winds for the company due to technological changes in areas such as wireless networks. He said 5G technologies, especially smartphones, artificial intelligence, smart edges and smart user devices, are all major sources of growing demand as they all require more memory and data storage.

Despite the optimistic outlook, Mehrotra said the company was “very cautious” in its approach to factories and manufacturing capabilities. “We want to expand the supply based on long-term demand trends,†said the CEO.

But at this point Micron’s inventories are “very low” and the company expects the industry to continue to run out from the end of this year to 2022. Demand is also increasing. “

Micron’s stock price fell 5.7% on Thursday to $ 80.11 per share. Inventories have increased by more than 6% since the start of the year.

– – Reuters contributed to this report.

[ad_2]